The Central Bank has retained mortgage lending restrictions but has made a slight adjustment to the level of exemptions on those limits.

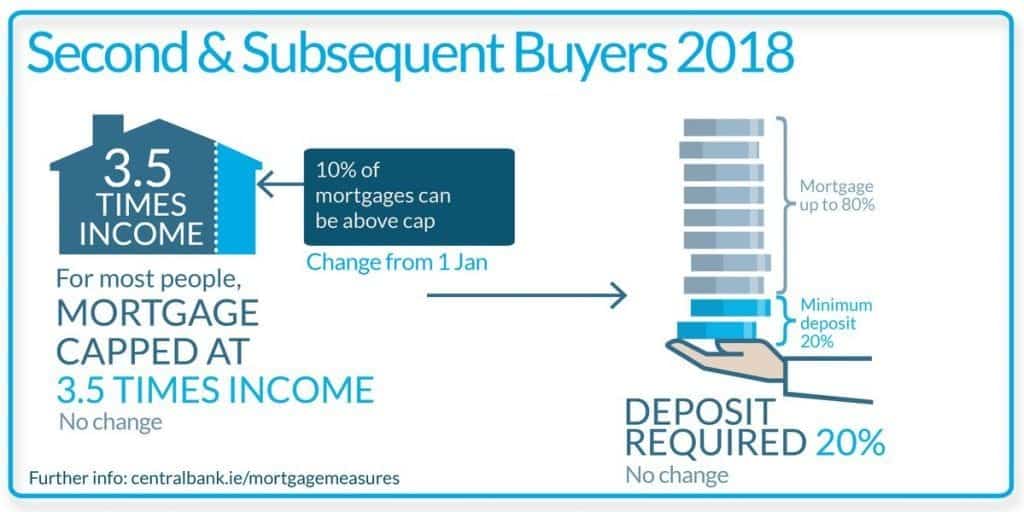

The change will see most buyers restricted to borrowing no more than three-and-a-half times their income while first-time buyers will still be required to have a deposit of 10% of the property’s value, with a 20% deposit needed by second and subsequent buyers.

Until now banks could allow 20% of all borrowers an exemption from the income limits – this exemption did not distinguish between new and second-time buyers.

Nonetheless banks will be able to exempt up to 20% of first-time buyers from the rules, if they qualify for an exemption.

Central Bank governor Philip Lane said ”The larger allowance for above-ceiling lending to first-time buyers compared to second and subsequent buyers reflects the different characteristics of these two groups.”

He added that the lending limits remain sufficiently flexible to allow the Central Bank to respond to risky lending developments, should they arise in either buyer group.

Don’t forget you can keep up-to-date on all things Nova over on our Instagram page – follow us for all the craziness of radio life coupled with news, sports and LOTS of cool competitions! Click here…