Daftmortgages.ie urges mortgage holders in the face of rising costs to control the controllables and switch mortgages to save thousands.

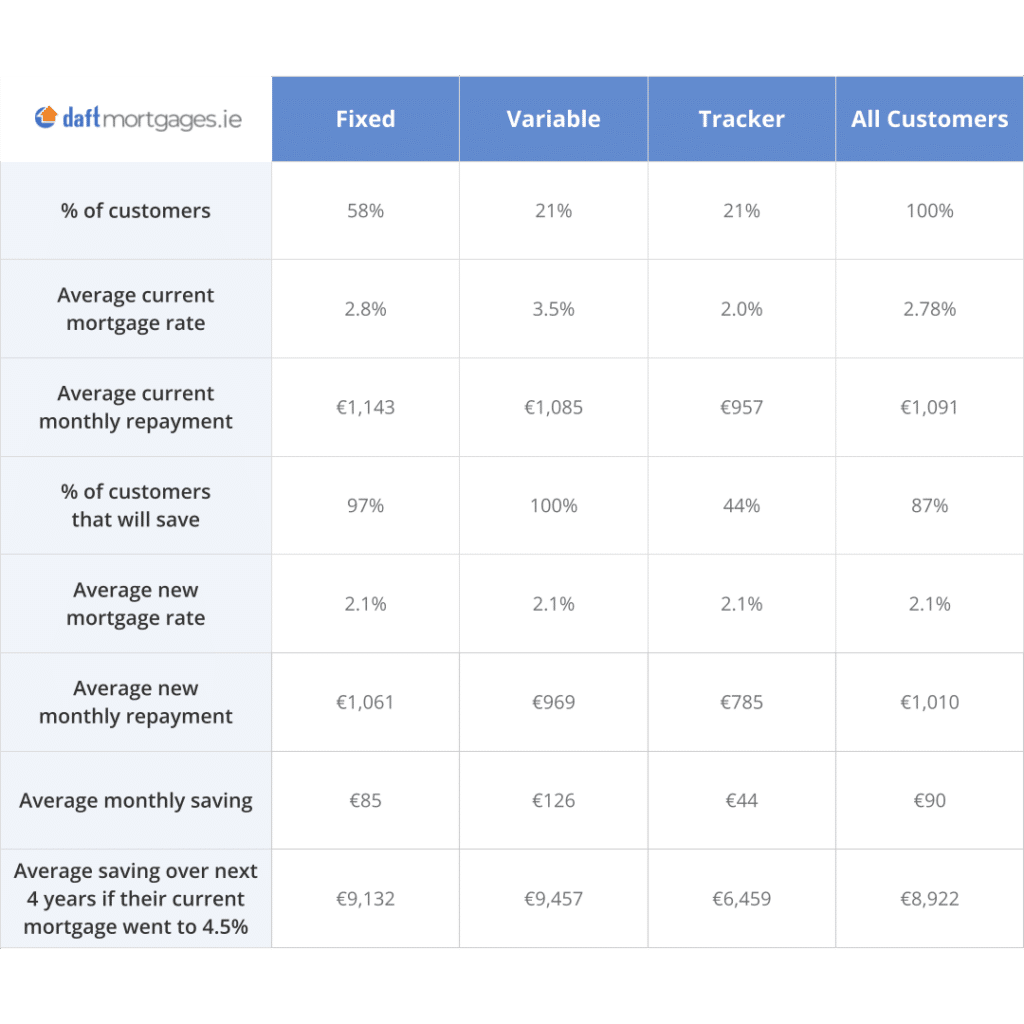

A recent analysis by daftmortgages.ie, finds that 87% of mortgage holders will save an average of €90 on their monthly mortgage repayments by switching now.

Furthermore, 96% of mortgage holders would save over the next few years by locking in current fixed rates, rather than being exposed to interest rate rises and seeing their mortgage repayments increase.

On average they will save €8,922 over 4 years on a new fixed rate! This is based on mortgage interest rates rising 2% in the coming years compared to mid 2022. This data is based on the findings from an analysis of over 150 personalised switch and save reports which current mortgage holders requested from daftmortgages.ie.

88% of the 260 mortgage holders surveyed by daftmortgages.ie said they have never switched their mortgage. Although switching is up 52% this year compared to last, this is actually just 1% of people who could switch and save actually switching this year.

4,410 mortgage switches took place between January and June 2022. There were 802,590 mortgages in Ireland at the end of June 2022. This means that only around 1% of mortgages will be switched in 2022, even though almost all could save money by switching now.

Mortgage interest rates have been falling for 10 years or so, but we’re at the bottom now. Some lenders rates have started to go up but many haven’t yet. You can’t cap your energy bill but you can cap your mortgage. Anyone who currently has a mortgage can switch their mortgage to a different provider to avail of a better rate and save thousands.”

The average saving by switching and fixing interest rates now is just over €8,900 over the next 4 years for current mortgage holders. So why aren’t people switching? daftmortgages.ie found there are three main reasons mortgage holders are not considering switching their mortgage; 1. 48% don’t know if they’d save by switching 2. 40% haven’t considered switching because of the effort involved and 3. 24% think being on a fixed rate is a blocker. (Percentages sum to more than 100% as some customers cited more than one reason.)

48% of mortgage holders surveyed said they don’t know if they would save money by switching their mortgage. A recent analysis by daftmortgages.ie, finds that 96% would save over the next few years by locking in current fixed rates, rather than being exposed to interest rate rises.

- Daftmortgages.ie data from their personalised savings reports conclude that 87% of mortgage holders would save an average of €90 on their repayments from month 1 if they switched mortgage now.

- Furthermore, 96% of mortgage holders would save over the next few years by locking in current fixed rates, rather than being exposed to interest rate rises and seeing their mortgage repayments increase. This is based on mortgage interest rates rising 2% in the coming years compared to mid 2022.

- The average saving by switching and fixing interest rates now is just over €8,900 over the next 4 years for current mortgage holders.

- Why should people change now? Mortgage interest rates in Ireland fell for a decade. Central Bank of Ireland data shows that the average owner occupier mortgage rate reached a low of 2.45% in Q2 2022. However rates are now rising as some lenders have increased their rates since then. Other lenders have not increased their rates yet, giving customers an opportunity to now cap their mortgage repayments, but people should act quickly.

- 4,410 mortgage switches took place between January and June 2022. There were 802,590 mortgages in Ireland at the end of June 2022 This means that only around 1% of mortgages will be switched in 2022, even though almost all could save money by switching now.

- So, why aren’t people switching?

- 48% of mortgage holders surveyed said they don’t know if they would save money by switching their mortgage. Daftmortgages.ie found that 96% of mortgage holders would save by switching.

- 40% of mortgage holders said they haven’t considered switching because of the effort involved with switching; however 92% of those who have switched their mortgage already said it was worth it for the savings.

- 24% of those on a fixed rate thought being on a fixed rate was a blocker to switching mortgage; it isn’t! Most customers can break now with no break fee. These fixed rate customers are the largest segment of the mortgage market and the average saving for them by switching is €85 a month. When interest rate rises of 2% are factored in, they save an average of €9,132 over the next 4 years by fixing and capping their mortgage repayments.

- These findings are based on an analysis of over 150 current mortgage holders who requested a personalised switch and save report from daftmortgages.ie and a survey of over 250 mortgage holders.

- Daftmortgages.ie highlights that anyone with a mortgage should act and switch now to get themselves the best rate possible.

Most customers can break now with no break fee. Our analysis shows that 97% of those on a fixed rate currently would save on average €9,132 (when interest rate rises of 2% are factored in) over the next 4 years by fixing and capping their mortgage repayments now.

These fixed rate customers are the largest segment of the mortgage market and the average saving for them by switching is €85 a month.

In regards to break fees, Paul Monahan, General Manager at daftmortgages.ie states “at the moment, most customers breaking their fixed rate mortgage are not being charged a break fee. I’d advise any customer on a fixed rate mortgage to call their lender and ask how much it would cost them to break — it’s definitely free just to find out! Given that interest rates are rising, almost every fixed or variable rate mortgage holder will benefit from taking a new fixed rate now and locking in today’s mortgage rates that start at around 2%.”

What should people do? Customers should contact a mortgage broker who will tell them how much they will save and guide them through the switching process. Customers can search online for a broker or go to daftmortgages.ie.

Paul Monahan, General Manager at daftmortgages.ie says “Switching mortgage providers is one of the most effective things that people can do to reduce their outgoings. I would urge mortgage holders in the face of rising costs to control the controllables and switch mortgages to save thousands.”